Finding the right banking partner is critical for real estate investors. High fees, limited services, and poor software integration can significantly impact profitability. This article examines the best banks for real estate investors in 2024, considering factors beyond interest rates. We’ll analyze top contenders, highlighting their strengths and weaknesses to help you make an informed decision.

Toc

- 1. Key Factors to Consider When Choosing a Bank for Real Estate Investments

- 2. The Rise of Fintech in Real Estate Banking

- 3. Top Banks for Real Estate Investors in the USA: A Detailed Comparison

- 3.1. Bank of America: A Traditional Powerhouse

- 3.2. Chase: A Comprehensive Offering

- 3.3. Baselane: An Integrated Solution

- 3.4. U.S. Bank: A Solid Traditional Choice

- 3.5. Bluevine: Digital Banking with Benefits

- 3.6. Stessa: Specialized for Landlords

- 3.7. Relay: Focused on Cash Flow Management

- 3.8. Grasshopper: High Yields and Support

- 3.9. Other Notable Mentions

- 4. Best Banks for Specific Real Estate Investment Strategies

- 5. Beyond Banking: Essential Financial Strategies for Real Estate Success

- 6. Frequently Asked Questions (FQAs) about Banking for Real Estate Investors

- 7. Conclusion

- 8. Related articles 02:

- 9. Related articles 01:

Key Factors to Consider When Choosing a Bank for Real Estate Investments

When selecting the best banks for real estate investors, it’s essential to look beyond just interest rates. Several key factors can significantly influence your investment journey and financial success.

Low or Waived Monthly Fees

For real estate investors, monthly banking fees can quickly add up, eating into your profits. Seek banks that offer low or waived monthly fees, particularly those that allow fee waivers based on minimum balances or transaction volumes. This offers a significant advantage for newcomers in the real estate market who are just starting to build their portfolios. For example, while Bank of America may have higher base fees, their Preferred Rewards program waives fees for customers maintaining substantial balances. Conversely, online-only banks like Chime often advertise completely fee-free accounts but may lack the extensive services of larger institutions. This highlights the trade-off between cost and service breadth.

Acceptance of Diverse Payment Methods

Real estate transactions often involve various payment types, including cash, checks, and electronic transfers. Choosing a bank that supports multiple payment methods is crucial. This flexibility not only enhances tenant satisfaction but also simplifies cash flow management.

User-Friendly Online and Mobile Banking

In our fast-paced digital world, managing finances remotely is essential. Look for banks that offer robust online and mobile banking features, such as mobile check deposits, online bill pay, and real-time account alerts. These features save time and provide peace of mind, allowing you to keep track of your finances wherever you are.

Seamless Software Integrations

Integrating your banking with accounting software like QuickBooks or property management platforms can streamline your financial management. Recent advancements in Application Programming Interfaces (APIs) have improved data exchange between banking platforms and accounting software. For instance, Plaid, a financial data aggregator, allows many banks to seamlessly integrate with popular accounting solutions like QuickBooks Online and Xero. However, not all banks offer equally robust API integrations; some may require manual data entry, negating the time-saving benefits. Therefore, investors should verify the bank’s API capabilities before committing.

High-Yield Interest-Earning Accounts

While focusing on expenses is vital, it’s also wise to consider how your operating funds can work for you. High-yield interest-earning accounts can provide an additional income stream. However, while high-yield accounts offer attractive returns, it’s crucial to remember that interest rates fluctuate. Furthermore, the FDIC insurance limits ($250,000 per depositor, per insured bank, for each account ownership category) might not cover the entirety of a large real estate investor’s funds, necessitating diversification across multiple institutions. Evaluate the interest rates offered by different banks to determine if a high-yield checking or savings account aligns with your needs.

Access to Commercial Real Estate (CRE) Loan Products

For investors looking for financing options, access to commercial real estate loans is essential. Not all banks provide the same loan products, so it’s important to assess the terms, interest rates, and eligibility criteria across various institutions. This consideration is particularly relevant if you’re planning to expand your real estate portfolio.

Customer Service and Support Options

Reliable customer service is a cornerstone of a good banking relationship. Ensure that the bank you choose offers comprehensive customer support options, including accessible online chat, phone support, and in-person assistance if needed. This can make a significant difference when you require immediate help or have specific inquiries.

The Rise of Fintech in Real Estate Banking

The real estate finance landscape has seen a surge in fintech companies offering specialized services. These firms often leverage technology to provide streamlined processes, lower fees, and potentially higher interest rates on savings accounts. However, the relative newness of many fintechs means a lack of extensive history and established customer support structures compared to traditional banks, posing a potential risk for some investors.

Top Banks for Real Estate Investors in the USA: A Detailed Comparison

Having considered the key factors, let’s now examine leading banking options for real estate investors. A mix of traditional banks and fintech options emerges as top contenders. Here’s a detailed comparison of some of the best banks for real estate investors, including Bank of America , Chase , Baselane, and others.

Bank of America: A Traditional Powerhouse

Bank of America stands out as one of the best banks for real estate investors due to its extensive branch network and comprehensive range of services.

Pros:

- A wide array of business services and products.

- Competitive commercial real estate loan options.

Cons:

- Potentially higher fees compared to online-only banks.

- Limited interest-earning checking accounts.

Bank of America offers tailored services for real estate investors, including various business checking accounts and CRE loan programs. They also provide fee waivers under specific conditions, making them a viable choice for many investors.

Chase: A Comprehensive Offering

Chase is another strong contender recognized for its extensive range of commercial real estate loans and various business checking options.

Pros:

- Competitive sign-up bonuses and diverse loan products.

- Robust online banking features.

Cons:

- Monthly fees that can be waived under certain conditions.

- Limited free transactions.

Chase also excels in software integrations, making it easier for real estate investors to manage their finances effectively.

Baselane: An Integrated Solution

For investors seeking an all-in-one platform, Baselane offers integrated banking, bookkeeping, and rent collection services specifically designed for landlords.

Pros:

- No monthly fees and competitive annual percentage yields (APY).

- Comprehensive management tools tailored for landlords.

Cons:

- Digital-only banking with no physical branches.

- Limited traditional banking services.

Baselane is uniquely designed for real estate investors, providing a streamlined platform that simplifies various financial processes.

U.S. Bank: A Solid Traditional Choice

U.S. Bank has a strong national presence and offers robust commercial real estate loan products.

Pros:

- Fee-free business checking and excellent customer service.

- A good variety of lending options.

Cons:

- Expensive wire transfer fees and a required opening deposit.

- Limited free transactions.

This bank is a solid choice for real estate investors seeking a traditional banking experience with comprehensive loan offerings.

Bluevine: Digital Banking with Benefits

Bluevine is a digital bank that appeals to small business owners, offering high-yield interest-earning checking accounts.

Pros:

- Competitive line of credit options and no monthly fees.

- Excellent software integrations.

Cons:

- Fees for cash deposits at retail locations.

- No physical branches.

Bluevine’s offerings are particularly attractive for investors prioritizing online banking and the ability to earn interest on their operating funds.

Stessa: Specialized for Landlords

Stessa provides a specialized cash management system for landlords, combining banking with property management tools.

Pros:

- High-yield accounts with no monthly fees.

- Seamless online rent collection features.

Cons:

- No loan products or cash deposit options.

- Digital-only banking.

For landlords looking for a dedicated platform for managing their rental properties, Stessa offers a unique solution that meets their needs.

Relay: Focused on Cash Flow Management

Relay is an online-only banking provider focused on cash flow management for real estate investors.

Pros:

- No monthly fees and multiple checking accounts.

- Excellent collaboration tools for teams.

Cons:

- Lacks traditional lending products.

- Requires online banking for all services.

Relay is particularly beneficial for real estate investors who manage multiple properties and need efficient transaction management.

Grasshopper: High Yields and Support

Grasshopper stands out for its uncapped APY and SBA lending solutions.

Pros:

- No monthly fees and strong interest rates on checking accounts.

- Excellent customer support.

Cons:

- No cash deposits accepted.

- Requires an opening deposit to start.

Grasshopper’s offerings make it a good choice for investors looking for high yields and lending options.

Other Notable Mentions

Several other banks and credit unions cater to real estate investors. Options frequently recommended on platforms like Reddit include community banks and regional credit unions that offer personalized service and competitive products. Each of these institutions has unique strengths, making it worthwhile to explore their offerings.

Best Banks for Specific Real Estate Investment Strategies

The best banks for real estate investors will vary depending on your specific investment strategy. Here’s how to choose the right bank based on your needs:

For Single-Family Rental Investors

Single-family rental investors should prioritize banks with strong online banking features, convenient rent collection tools, and access to small business lines of credit. This approach can enhance your financial operations and improve tenant management.

For Large-Scale Commercial Real Estate Investors

Investors focused on larger commercial properties will benefit from banks that offer extensive CRE loan programs, treasury management services, and advanced financial analysis tools. These features can support more complex financial needs.

For Real Estate LLCs

When banking for a real estate LLC, it’s crucial to maintain a clear separation between business and personal finances. Seek banks that provide specialized services tailored to LLCs, including business checking accounts and access to lending products.

For Real Estate Agents

Real estate agents often have unique banking needs, such as convenient deposit options and robust online banking features. Consider banks that integrate with customer relationship management (CRM) software to streamline your operations.

Beyond Banking: Essential Financial Strategies for Real Estate Success

While selecting the right bank is essential, implementing effective financial strategies is equally important.

Effective Bookkeeping and Expense Tracking

Accurate bookkeeping is critical for real estate investors. Using accounting software integrated with your bank can simplify tracking expenses and maintaining financial records. This practice enables you to understand your cash flow and make informed decisions.

Tax Planning and Optimization

Real estate investments come with various tax implications. Collaborating with a tax professional who understands real estate can help you maximize available deductions and credits, leading to significant savings and improved cash flow.

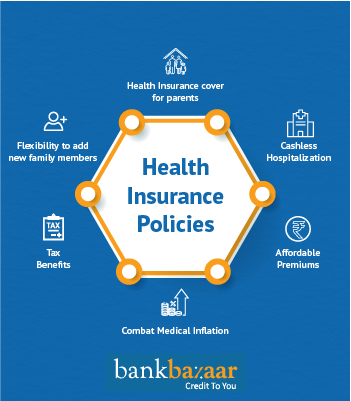

Risk Management and Insurance

Protecting your investments is paramount. Explore various insurance options, including property, liability, and rental insurance. These measures can mitigate risks and safeguard your assets.

Frequently Asked Questions (FQAs) about Banking for Real Estate Investors

What Should I Look for in a Business Bank Account?

When opening a business bank account, consider factors such as monthly fees, transaction limits, and the availability of online banking features. Additionally, evaluate how well the bank integrates with your accounting software.

How Do I Manage Cash Flow as a Real Estate Investor?

Effective cash flow management involves meticulously tracking income and expenses. Utilize budgeting tools and accounting software to gain insights into your financial health.

Are Online Banks Safe for Real Estate Investors?

Yes, many online banks are FDIC-insured and provide robust security measures. However, it’s crucial to research the bank’s reputation and customer reviews before opening an account.

Conclusion

Choosing the best banks for real estate investors is a crucial decision that can significantly impact your financial success. By carefully considering the factors discussed in this article and comparing the features of different banks, you can find the ideal banking partner to support your growth and profitability. Start researching your options today and make an informed choice that aligns with your unique investment strategy. Remember to regularly review your banking needs as your portfolio evolves, especially as trends in fintech and banking continue to develop. By combining the right banking partner with effective financial strategies, you can enhance your investment experience and achieve your real estate goals.

1. https://vuanghenhac.com/mmoga-finding-the-best-real-estate-agents-in-nashville-tn/

2. https://vuanghenhac.com/mmoga-finding-the-best-real-estate-agents-in-my-area-a-kingman-az-guide/

4. https://vuanghenhac.com/mmoga-the-best-real-estate-advertising-strategies-for-agents-in-2024/

5. https://vuanghenhac.com/mmoga-doug-hopkins-real-estate-reviews-a-comprehensive-guide-for-sellers/

1. https://vuanghenhac.com/mmoga-doug-hopkins-real-estate-reviews-a-comprehensive-guide-for-sellers/

2. https://vuanghenhac.com/mmoga-finding-the-best-real-estate-agents-in-nashville-tn/

4. https://vuanghenhac.com/mmoga-finding-the-best-real-estate-agents-in-my-area-a-kingman-az-guide/

5. https://vuanghenhac.com/mmoga-the-best-real-estate-advertising-strategies-for-agents-in-2024/